When planning for retirement, choosing the right investment is essential. Annuities vs mutual funds are common options for financial planning. Both have their pros and cons, and each can cater to different needs.

But which one is better suited for your goals? Will safety or growth be your priority? In this blog, we’ll break down the advantages and disadvantages. We aim to help you make a well-informed decision.

This understanding is vital for a solid financial strategy. So, let’s explore annuities vs mutual funds and enhance your financial planning today.

Understanding Annuities and Mutual Funds

It’s crucial to understand what annuities and mutual funds are. An annuity is an insurance product designed for retirement planning. In simple terms, it’s a contract between you and an insurance company.

You purchase an annuity by paying a lump sum or making regular payments. The insurer then invests your money in different assets, such as stocks and bonds. You receive a fixed income during your retirement years, based on the contract’s terms.

Mutual funds are professionally managed investment options. They pool funds from various investors to invest in securities like stocks and bonds.

Mutual funds offer diversity and liquidity. They are also suitable for both long-term and short-term financial goals.

Pros of Annuities

Annuities have distinct advantages. These include:

Guaranteed Income

One major advantage of an annuity is that it guarantees a fixed income for life or a specified period. It can be reassuring during retirement when you may not have a regular salary or income. Annuities can provide financial security and peace of mind, ensuring you can cover essential expenses.

Tax-deferred Growth

Annuities offer tax-deferred growth, meaning earnings on your investment are not taxed until you withdraw them. It can help increase the value of your investment over time. Annuities can provide a steady stream of income during retirement.

Protection from Market Volatility

Annuities protect from market volatility. It means that even if the stock market crashes, your annuity’s value will not be affected. It makes annuities a more secure option for risk-averse investors.

Customizable Options

Annuities offer various customizable options, such as choosing between fixed or variable interest rates, payout frequency, and death benefit options. It allows you to tailor your annuity to fit your specific needs. They provide a reliable source of income for retirement planning.

Cons of Annuities

Along with their advantages, annuities also have some disadvantages. These include:

High Fees

Annuities often have high administrative and management fees, surrender charges, and mortality and expense charges. These fees can significantly impact your overall returns. It’s crucial to understand all associated costs before investing in an annuity.

Limited Liquidity

Annuities do not offer much liquidity. Withdrawing money from an annuity before the contract’s term can result in penalties or surrender charges. Yet, annuities can provide a reliable income stream for retirement.

No Inflation Protection

Annuities usually offer a fixed rate of return, meaning that your investment does not account for inflation. It means that over time, the purchasing power of your annuity income may decrease.

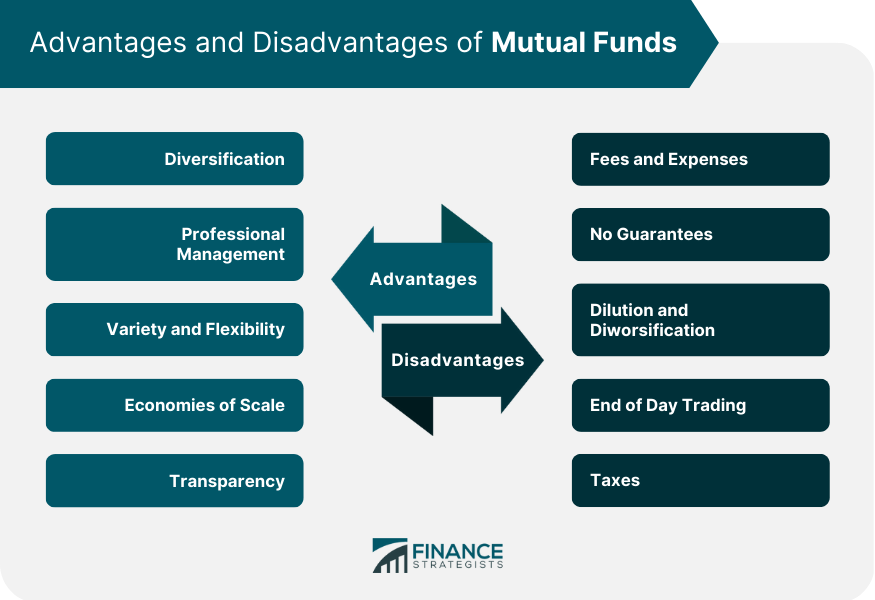

Pros of Mutual Funds

Like annuities, mutual funds have their own set of advantages. These include:

Diversification

Mutual funds offer diversification by investing in a variety of assets. It helps reduce the risk associated with investing in a single security. They are managed by professional fund managers who make informed investment decisions on behalf of investors.

Liquidity

Mutual funds are highly liquid, meaning you can buy or sell your shares without incurring any penalties. It makes them a flexible investment option for many investors.

Professional Management

Mutual funds are managed by financial experts who make investment decisions on behalf of the investors. It takes away the stress and time associated with actively managing investments. They offer diversification, reducing the risks involved in investing.

Cons of Mutual Funds

While mutual funds offer benefits, they also have their drawbacks. These include:

Market Volatility

As mutual funds invest in the stock market, they are subject to market volatility. It means that your investment’s value can fluctuate depending on the performance of the market. It’s important to consider your risk tolerance and investment horizon before investing in mutual funds.

Taxes

Mutual funds do not offer tax-deferred growth. Any earnings from your investment are subject to taxes in the year they are received. This can impact your returns. Yet, mutual funds often provide more flexibility and access to a wider range of investment options.

Fees

Mutual funds also have fees, such as management and administrative fees, which can affect your returns. It’s important to research and compare different mutual fund options to find the most cost-effective one for your goals.

Making an Informed Choice

When deciding between annuities and mutual funds, no one-size-fits-all answer exists. Your choice should depend on your financial goals, risk tolerance, and retirement needs.

Are annuities a good investment? If you focus on guaranteed income and protection from market fluctuations, they might be. They provide a dependable income stream during retirement, but it’s essential to be aware of the high fees and limited liquidity.

If you value flexibility, liquidity, and professional management, mutual funds may be the better option. With mutual funds, you can easily buy and sell shares and enjoy a diversified portfolio managed by financial experts. Yet, keep in mind that mutual funds are subject to market volatility and do not offer tax-deferred growth.

To make an informed choice, consider speaking with a financial advisor who can help assess your individual needs and goals. Understanding the strengths and weaknesses of each option will enable you to create a balanced and robust financial plan for the future.

Learn More About Annuities vs Mutual Funds

Choosing between annuities vs mutual funds is a critical decision. Each has unique benefits that cater to different needs. Annuities offer guaranteed income and protection from market fluctuations.

Mutual funds provide liquidity, diversification, and professional management. With proper wealth management, your investment can grow over time. Always assess your financial goals before making a choice.

Consult a financial advisor to guide you. It ensures a robust financial strategy for retirement planning. Make informed decisions that suit your future needs.

Did you find this article helpful? If so, check out the rest of our site for more informative content.

Description: Understand the advantages and drawbacks of annuities vs mutual funds. Make informed investment decisions with insights into these financial products.